Lugares de interés (POIs) del Mapa

0: Allies Copper Mine

Other names: Allies 2 - Sisengo - Changwe

The Allies Mine was first worked between 1914 and 1922, when 12 shallow shafts were sunk.Between 1962 and 1965, Charteredex sampled the shafts and returned grades of up to 5.49m averaging 3.23% Cu. Geochemical sampling outlined a north-south, 152m long anomaly >10,000ppm Cu. A 910m long 50ppm to 100ppm Cu anomaly to the north of historical workings was found to be underlain by laterite. Turam, self-potential electrical geophysical and magnetic surveys identified continuous linear targets over 180m in length, with strong anomalies to the north of the workings. Pitting and trenching within laterite over the northern anomaly was unsuccessful due to a shallow water table. A total of 14 diamond drillholes were completed within the main zone and into the northern anomaly, mostly to shallow depth (~100m). The best reported result within the main zone was 6.5m averaging 5.09% Cu, whilst no significant results are reported from the northern anomaly. Underground channel sampling at –60RL returned a best result of 1.52m averaging 8.31% Cu. Chartedex estimated an “indicated reserve” of oxide and sulphide ore, calculated with a 1% Cu cutoff, of 164,000t averaging 3.76% Cu.Recent artisnal activity has resulted in the identification of oxide copper mineralisation within shallow pits up to 200m south of the existing open pit.

AIM-Admission document 2004 (100p)

Mulofwe Project (PL219) Chongwe Copper Belt

-15° 15' 44.01", +28° 38' 53.61"

Más sobre Allies Copper Mine 2: Area 2 - Kawiri (Vale/ARM Antofagasta)

Placemark at Center point of Area 2 (12° 19' 14.26", +27° 53' 22.75"

RESOURCE BASE - HISTORICAL

(1988) Kawiri South: 16Mt at 1.52% Cu

Joint Venture Agreement:

70% TEAL Exploration & Mining Incorporated

30% Antofagasta Minerals Plc (ANTO can earn up an additional 20%)

April 8, 2008

Area 2 Kinsenda West - PLLS 73: Kawiri copper prospect and other drill-ready exploration prospects

Area 4 - PLLS 100: Kabula, Chipopo, Katembula and CFA3 copper prospects

(ex Korea Zinc Copperbelt JV - PLLS 72-73-74-100-102 dated March 9, 2005)

Area 2 Geology:

Deep basin lying east and northeast of Konkola/Konkola North. Northern and southern edges comprise Roan Group. Central parts comprise Nguba Group. Type 1a, 1b and Type 2 targets.

In Area 2 (PLLS 73) Lower Roan stratigraphy extends from the previously defined Kawiri zone of mineralisation towards the very rich Kinsenda deposit in the DRC. The Kawiri mineralisation comprises 16Mt at 1.52% total Cu (Freeman, 1988). A high resolution airborne magnetic survey was undertaken by ARMZ, but no follow-up work has yet been undertaken. TEAL intends to assess the potential for the continuation of the mineralisation into PLLS 73.

Historical drilling: 21 diamond drillholes.

TEAL: 5 diamond drillholes. No economic intersections were drilled

Technical Report on Sedar dated October 21, 2005 (2216K)

Antofagasta Minerals Plc (LSE:ANTO)

3: Area 4 (Vale/ARM Antofagasta)

Placemark at Center point Area 4 (-12° 48' , +27° 48' )

Joint Venture Agreement:

70% TEAL Exploration & Mining Incorporated

30% Antofagasta Minerals Plc (ANTO can earn up an additional 20%)

April 8, 2008

Area 4 - PLLS 100: Kabula, Chipopo, Katembula and CFA3 copper prospects

Area 2 - PLLS 73: Kawiri copper prospect and other drill-ready exploration prospects

(ex Korea Zinc Copperbelt JV - PLLS 72-73-74-100-102 dated March 9, 2005)

Area 4 Geology:

Large area west of the Kafue anticline. Two prominent basement domes surrounded by Roan Group sediments. Deep basins in the north and south are filled with both Roan and Nguba Group sediments. Nguba Group intensely folded and faulted in the north (Chipopo). Type 1a & Type 2 Targets.

Historical drilling: 77 diamond; wagon auger Chipopo area (330 holes), Chiryongoli (Kabula) area (550 holes).

TEAL drilling: Diamond drillholes: 3, total 1,221m. Machine auger: 175 holes, total 2,121m.

Historical Mineral Resources (1988) :

Kabula: 1.3Mt at 2.04% Cu

CFA3: 1.6Mt at 0.92% Cu

Katembula North: 0.12Mt at 2.90% Cu

Katembula South: Denovan Camp, Kasungu River

TEAL drilled two holes into the Kabula prospect to verify the grade and high silver grades were also encountered. The area was never assayed for precious metals in the past. TEAL intends to carryout a reinterpretation of the geology of this area, specifically considering the distribution of precious metals.

Technical Report on Sedar dated October 21, 2005 (2216K)

Antofagasta Minerals Plc (LSE:ANTO)

Más sobre Area 4 (Vale/ARM Antofagasta)4: Area 4 (Vale/ARM Antofagasta)

Joint Venture Agreement:

70% TEAL Exploration & Mining Incorporated

30% Antofagasta Minerals Plc (ANTO can earn up an additional 20%)

April 8, 2008

Area 4 - PLLS 100: Kabula, Chipopo, Katembula and CFA3 copper prospects

Area 2 - PLLS 73: Kawiri copper prospect and other drill-ready exploration prospects

(ex Korea Zinc Copperbelt JV - PLLS 72-73-74-100-102 dated March 9, 2005)

Area 4 Geology:

Large area west of the Kafue anticline. Two prominent basement domes surrounded by Roan Group sediments. Deep basins in the north and south are filled with both Roan and Nguba Group sediments. Nguba Group intensely folded and faulted in the north (Chipopo). Type 1a & Type 2 Targets.

Historical drilling: 77 diamond; wagon auger Chipopo area (330 holes), Chiryongoli (Kabula) area (550 holes).

TEAL drilling: Diamond drillholes: 3, total 1,221m. Machine auger: 175 holes, total 2,121m.

Historical Mineral Resources (1988) :

Kabula: 1.3Mt at 2.04% Cu

CFA3: 1.6Mt at 0.92% Cu

Katembula North: 0.12Mt at 2.90% Cu

Katembula South: Denovan Camp, Kasungu River

TEAL drilled two holes into the Kabula prospect to verify the grade and high silver grades were also encountered. The area was never assayed for precious metals in the past. TEAL intends to carryout a reinterpretation of the geology of this area, specifically considering the distribution of precious metals.

Technical Report on Sedar dated October 21, 2005 (2216K)

----------------------------------------------------------

Antofagasta Minerals Plc (LSE:ANTO)

Más sobre Area 4 (Vale/ARM Antofagasta)7: Argosy Cu-Zn (Vale/ARM)

Area not defined

RESOURCE BASE - Dasen

490Kt at 1.10% Zn and 1.10% Cu

Technical Report on Sedar dated October 21, 2005 (2216K)

Latitude. -15.5°, Longitude. 28.0166667°

Más sobre Argosy Cu-Zn (Vale/ARM)8: Aries Beryllium Mine

Area not defined

Abandonned Surface Beryllium Mine

767228mE, 8487844mN

-13° 39' 57.79", +29° 28' 13.22"

Más sobre Aries Beryllium Mine9: Buffalo

Area not defined

517275mE, 8104430mN

-17° 8' 40.93", +27° 9' 44.71"

Más sobre Buffalo 15: Baluba Mine (CLM CNMC)

The Baluba mine has two shafts, B1-Shaft and B2-Shaft. The B1 shaft was sunk in 1973 and on the northern side of the ore body. It is used as a rock hoisting shaft and was sunk to 718m level. The B2 shaft was also sunk in 1973 and is adjacent to B1-Shaft. It is used as a service shaft for man-riding and material transport. It was sunk to 688m level (Source LCM EIS Vol1, 2004). The ore at Baluba mine is conveyed to the processing plant through a 11.5km cable conveyer belt where copper and cobalt concentrates are produced.

(photo George Maxwell)

17: Bwana Mkubwa (BMML FirstQuantum)

July 28, 2010 - Production will be suspended later in August. (Reuters) Bwana Mkubwa had exhausted the copper ore oxide it imported from neighbouring Democratic Republic of Congo [Lonshi] and operations would be suspended until the plant sourced other economically viable raw materials.

HISTORY

• In May of 1997, the facility at Bwana was issued a large scale mining license for copper mining in the Ndola area by the government of Zambia, replacing the original mining license granted to the Company in 1996. In 1998, the Company completed construction of a 10,000 tpa copper cathode SX/EW tailings retreatment and sulphuric acid plant.

• In 2000, the Company discovered the Lonshi copper deposit and, in 2001, began construction and expansion at Bwana to enable the processing of ore from Lonshi. Further expansion in 2002 resulted in an increase in grade “A” copper cathode production capacity by 30,000 tpa. Tailings at Bwana were principally depleted in 2002 and Bwana,after completion of a modification program, began sourcing ore from Lonshi for the production of copper cathode.

• Further expansion, including the construction of the Bwana-Lonshi division’s acid plant in Solwezi, allowed Bwana to increase both its copper cathode and sulphuric acid production. On July 26, 2006, Bwana entered into a Development Agreement with the GRZ. In November 2007, the RDC-Zambian border between Lonshi and Bwana was closed for the export of ore from the RDC by the Governor of the Katanga Province. Mining continued at Lonshi and ore was stockpiled pending the expected opening of the border. The oxide resource was substantially depleted at Lonshi in August 2008. However, Bwana continued to source alternate sources of oxide ore in Zambia. In October 2008, Bwana announced the temporary suspension of copper cathode production, but continued to operate its acid plant. The Lonshi border was finally re-opened on November 5, 2009. The transfer of ore from Lonshi re-commenced on November 9, 2009 with Copper processing re-commencing on January 4, 2010.

PROCESSING

Bwana processes oxide ore [Lonshi-DRC exhausted] to produce copper cathode. Copper cathode is produced through a process of millings, leaching and SX/EW. Bwana owns four sulphuric acid plants, two of which are located at Kansanshi. Sulphuric acid plants incorporate sulphur burning to produce sulphur dioxide gas, gas cleaning and drying, conversion to sulphur trioxide and absorption, all of which result in the production of sulphuric acid.

FISHTIE OPEN PIT MINE PROJECT

In July 2009 Zambia approved First Quantum's plan to open a new copper mine in central Zambia to provide feedstock for the Bwana Mkubwa processing plant. First Quantum plans to mine 2.4 million tonnes of copper ore at the Fishtie deposit to supply feedstock to the Bwana Mkubwa plant at an estimated feed rate of 100 000 tonnes for month

OWNERSHIP

Bwana Mkuba Copper Mine - BMCM

subsidiary of Bwana Mkubwa Mining Ltd - BMML

subsidiary of First Quantum Minerals Ltd

First Quantum Minerals Ltd (TSX:FM, LSE:FQM)

Other names: Bwana Mukubwa

Other articles:

Más sobre Bwana Mkubwa (BMML FirstQuantum)18: Bwana Mkubwa Open Pit

Bwana Mkubwa was first worked around 700 AD and more recently during two periods, 1930-31 and 1971-1984. The latter 14-year period of production consisted of open-pit mining of mixed sulfide/oxide ore.

The level of mining in the area created large copper tailings and waste dumps, the largest of which, No. 4, covers 45 hectares. These dumps have been the initial focus of First Quantum's activities in the area. Various studies including a Bateman Engineering feasibility study completed in August 1996 concluded that there remains significant concentrations of recoverable copper on the property from tailings, waste and hard rock sources. Drill testing of only the No. 4 oxide tailings dump defined a reserve of 8.4 million tonnes grading 0.73% copper. In addition, Zambia Consolidated Copper Mines (ZCCM) reported 230,000 tonnes grading 2.54% copper in the west wall of the pit. A Watts, Griffiths and McOuat (WGM) 1990 report identified 900,000 tonnes grading 2.85% copper in the pit floor. Furthermore, WGM reported an additional resource of 3 million tonnes grading 1.4% copper in the immediate vicinity of the pit.

Más sobre Bwana Mkubwa Open Pit19: Carmanor Zn-Pb Prospect (Vale/ARM)

AREA

RESOURCE BASE - HISTORIC

4Kt at 11.70% Pb, 1.40% Zn

Map by Teal / Rosario Terracciano

Technical Report on Sedar dated October 21, 2005 (2216K) - page115

Kabwe West (PLLS 57)

Más sobre Carmanor Zn-Pb Prospect (Vale/ARM)20: Chakwenga Gold Mine (ZRL)

Rhodesian Minerals Concession Company (RMCC) surveyed the Chakwenga area during a regional geological mapping campaign in 1934. Soil geochemical surveying and trenching lead to the discovery of numerous gold occurrences, including Chakwenga where trench results included up to 30m averaging 19g/t Au.Underground exploration via two shafts and an adit commenced in 1935. Results from sampling ofstrike drives returned intervals including 30m averaging 8.2g/t Au at 24m depth and 40m averaging 6.6g/t Au at 45m depth. At 115m depth the zone split into two smaller shoots grading 8g/t Au and 4g/t Au.

On the basis of “reserves” of 20,000t estimated at between 5.6g/t and 7.0g/t Au, mining was commenced in 1939. Intermittent mining between 1940 and 1942 reportedly produced 2,077oz Au and 78oz Ag. RMCC sold on its interest in the mine in 1943.No significant exploration at Chakwenga is documented until 1980, when a prospector estimated the tailings at 14,500t averaging 3.3g/t Au.Zamanglo is reported to have conducted copper exploration within the Chakwenga area during the early 1960’s, included trenching and diamond drilling, however no documentation of this work has been recovered.

From historical data, the region within a 10 km radius of Chakwenga is known to contain in excess of 20 other gold and/or copper prospects.

Chakwenga Region Project*

779500mE, 8292000mN

-15° 26' 1.73", +29° 36' 15.73"

AIM Admission Document 2004 (100p)

ASX IPO Prospectus 2007 (128p)

*part of Zambezi Project (PL214):

Kangaluwi-Chisawa, Chakwenga Region, Other Chakwenga Region and Uranium JV Oryx

Más sobre Chakwenga Gold Mine (ZRL)21: Chalalobouka Cu (ZRL)

AREA

RESOURCE BASE - HISTORIC

2.36Mt at 2.96% Cu Sulphides

0.7Mt at 1.87% Cu Oxides

HISTORY

Chalalobouka was reportedly discovered by Charteredex in 1959 via regional geochemistry, as a peak anomaly of 1,250ppm Cu. Soil sampling and mapping identified a 200m long anomaly >500ppm Cu.Pitting, Banka drilling and mapping defined oxide mineralisation at the 4/0/78 anomaly over a strike length of 900m. Diamond drilling on a 120m spacing led to a sulphide “reserve” estimate of 1.37Mt averaging 3.38% Cu.

Soil sampling located a second anomaly, A/90/18, 2km to the southwest of 4/0/78. Turam and selfpotential electrical geophysical surveys identified strong anomalies and resulted in the discovery of blind mineralisation estimated at 0.5Mt averaging 1.3% Cu. Mineralisation was traced up to 400m east and west of 4/0/78, and by 1965 an indicated and possible sulphide “ore reserve” was estimated of 943,100t averaging 3.06% Cu (2% Cu cutoff) plus an oxide “ore reserve” estimated at 272,000t averaging 1.5% Cu.

Between 1969 and 1972, ZAMEX completed additional diamond drilling and established a revised estimate of the “reserves” of 0.5Mt averaging 1.83% Cu in oxide mineralisation, and 3.3Mt averaging 2.12% Cu as sulphide mineralisation (1% Cu cutoff). A feasibility study on the deposits was completed, but no mining undertaken. The reasons for not proceeding to mining are not well documented, however RSG Global notes that options for metallurgical processing were limited relative 58 to modern processing, and that the timing of the study coincided with Government moves to nationalise the industry.

Between 1974 and 1975, Metalimex Mining Limited (Metalimex) completed limited diamond drilling at the 50/59 and 4/0/78 deposits. Revised “reserves” are reported, although the associated documentation is limited. Metalimex estimated oxide “reserves” at 0.7Mt averaging 1.87% Cu, and sulphide “reserves” of 2.36Mt averaging 2.96% Cu.

http://www.zambeziresources.com/_content/documents/510.pdf

Mulofwe Project (PL219) Chongwe Copper Belt

Zambezi Resources (ASX:ZRL)

666800mE, 8316275mN

-15° 13' 27.37", +28° 33' 10.75"

Más sobre Chalalobouka Cu (ZRL)22: Chalimbana Cu (ZRL Glencore)

Other names: Chongwe East

RESOURCE BASE

Historic 7.7Mt at 0.95% Cu

JORC Inferred 5.3Mt at 0.8% Cu

Chongwe Copperbelt / Chalimbana Projects JV

49% Zambezi Resources Ltd

51% Glencore International AG (% after spending US$6M)

HISTORY

The first reported exploration at Chalimbana was by Rhodesian Selection Trust (RST) in 1955, when limited diamond drilling is reported. Between 1962 and 1965, RST completed diamond drilling and sampling of shafts (Figure 7) to establish an “indicated reserve” of 7.7Mt averaging 0.95% Cu, with a best intersection of 74.98m averaging 1.63% Cu.

Between 1970 and 1975, a winze was excavated to 67m vertical depth from which four horizontal diamond holes were drilled. Samples from the winze excavation and drilling were sent to Roan Consolidated Mines Research and Development Department for flotation and recovery test work.Results indicated that concentrates in excess of 25% Cu and generally containing 20% insoluble compounds, could be achieved with copper recovery greater than 90% or better. A feasibility study was completed, estimating “reserves” of sulphide mineralisation at 3.74Mt averaging 0.89% Cu,however the “computer” based estimation was subject to a number of uncertainties. No further work is documented.

http://www.zambeziresources.com/_content/documents/510.pdf

Chalimbana Deposit

Chalimbana Resources Zambia Ltd

100% subsidiary of Southern African Resources Bermuda Ltd

100% subsidiary of Zambezi Resources Ltd

Más sobre Chalimbana Cu (ZRL Glencore)24: Chambishi Copper Mine Privatisation (NFCA CNMC)

Chambishi Mine

Deposits claimed by Collier in 1903

Roan Selection Trust (RST) 1931-1969

Roan Copper Mines (RCM) 1969-1982

Zambia Consolidated Copper Mines (ZCCM) 1982-1998

NFC Africa Mining Plc (NFCA)

15% ZCCM Investment Holding Limited (ZCCM-IH)

85% China Nonferrous Metal Mining Co. Ltd (CNMC)

June 29, 1998

---------------------------------------------------------

ZAMBIA PRIVATISATION AGENCY

PRIVATISATION TRANSACTION SUMMARY SHEETS

BIDS RECEIVED:

At bid closing, 28 February 1997, bids for Chambishi Mine were received from the following bidders:

- AUR Resources Inc, a company incorporated in Canada.

- Farrell Associates Group, composed of LMX Resources Limited, GMD Resources Corporation and Farrell Financial Limited, all Canadian incorporated companies.

- First Quantum Minerals Limited, a company incorporated in Canada.

- Sterlite Industries Limited, a company incorporated in India.

After consideration, the GRZ/ZCCM Privatisation Negotiating Team decided to reject all the bids that were submitted for the purchase of Chambishi Mine.

A Restricted Tender was then called and all the companies that had pre-qualified for the purchase of this package were invited to participate. Bids were finally received from the following bidders:

- China National Non Ferrous Metal Industry Corporation (CNNC), a company incorporated in the Peoples Republic of China.

- Farrell Associates Group who decided to re-bid through GMD Resources Corporation.

- Ivanhoe Capital PTE Limited, a Canadian registered financial development group with headquarters in Singapore

- Jet Cheer Development (Z) Limited, a company incorporated in Zambia.

- Sterlite Industries Limited, a company incorporated in India.

i) China National Non Ferrous Metal Industry Corporation (CNNC)

Descriptions Offer

Shareholding requested 85%

ZCCM retained interest (10% free, 5% repayable) 15%

Cash at close US$6 m

Deferred/conditional cash (@ 12% NPV) US$7.4 m

Feasibility commitment US$10 m

ii) GMD Resources Corporation

Descriptions Offer

Shareholding requested 60%

ZCCM retained interest (0% free, 40% repayable) 40%

Cash at close US$1.5 m

Deferred/conditional cash (@ 12% NPV) Nil

Feasibility commitment Not stated

iii) Ivanhoe Capital PTE Limited

Descriptions Offer

Shareholding requested 85%

ZCCM retained interest (0% free, 15% repayable) 15%*

Cash at close US$4 m

Deferred/conditional cash (@ 12% NPV) US$10.56 m

Feasibility commitment US$10 m

* Free carried for 4 years up to US$80 million capital investment.

iv) Jet Cheer Development (Z) Limited

Descriptions Offer

Shareholding requested 80%

ZCCM retained interest (20% free, 0% repayable) 20%

Cash at close US$8.5 m

Deferred/conditional cash (@ 12% NPV) US$4.92 m

Feasibility commitment US$10.4 m*

* Excluding US$2.6 m claimed to have been spent

v) Sterlite Industries (India) Limited

Descriptions Offer

Shareholding requested 80%

ZCCM retained interest (20% free, 0% repayable) 20%*

Cash at close US$7.5 m

Deferred/conditional cash (@ 12% NPV) US$11.61 m

Feasibility commitment US$10 m

* Free carried interest is only up to the first rights issue and thereafter no carry

SUCCESSFUL BIDDER:

China Non Ferrous Metals Industries Corporation (CNNC)

COMMERCIAL TERMS:

a) ZCCM retained interest (10% free, 5% repayable) 15%

b) Cash at close US$ 20 m

c) Deferred/conditional cash @ 12% NPV0 US$ 7.4 m

d) Feasibility commitment (over 3 year) US $ 10 m

e) conditional Investment commitment (over 5 years) US4110M

MAJOR PROVISIONS OF THE SALE AND PURCHASE AGREEMENT AND THE DEVELOPMENT AGREEMENT

- A commitment to invest a total of US$ 110 million in the development of Chambishi Mine during the first five years from close.

- a programme to re-establish Chambishi Mine in three (3) phases:

- Phase 1 Restore operations and achieve a production capacity of 3,000 tonnes of ore per day with the first 18 months from close;

- Phase 2 Increase production capacity to 6,000 tonnes of ore per day, after 30 months;

- Phase 3 Thereafter, endeavour to achieve a production capacity of 9,000 tonnes of ore per day, depending on the outcome of further exploration work on Chambishi West and South East ore bodies.

- A commitment to support local business development;

- A Human Resources development programme;

- Recognition of the Mineworkers' Union of Zambia.

THE PURCHASER:

China Non-Ferrous Metals Corporation of the Peoples' Republic of China

China Nonferrous Metal Mining (Group) Co Ltd

CNMC boasts the most overseas nonferrous metal resources in China. At present, the projects both under development and operation include: Chambishi Copper Mine of Zambia, Tumurttin-Ovoo Zinc Mine of Mongolia, Tagaung Taung Nickel project of Myanmar, Thai-China lead-Antimony Alloy Plant, Mongolia Oyu Tolgoi Copper-Gold Project and so on... Chinese Investment Zone in Zambia centering around Chambishi copper mine is now being established.

Más sobre Chambishi Copper Mine Privatisation (NFCA CNMC)25: Chambishi Copper Mine (NFCA CNMC)

April 22, 2010Mr. Luo congratulated President Banda on his successful state visit to China from February 24th, 2010 to March 4th, 2010. Mr. Luo reported to President Banda the US$600 investment plan to the development of West Ore Body of Chambishi Copper Mine, Sino-Metals Leaching Plant, the second phase of Chambishi Copper Smelter, the central area of ZCCZ and innovation of Baluba copper mine and Muliashi Project and presented the master plan and phase plan of Lusaka sub-zone to President Banda. Mr. Luo said that CNMC will enlarge investment in Zambia under the guidance of Zambian and Chinese Government.

Más sobre Chambishi Copper Mine (NFCA CNMC)26: Chambishi Metals Privatisation

90% Anglovaal Mining Ltd (Avmin)

10% ZCCM-Investment Holdings Plc (ZCCM)

September 1998

90% ENYA Holdings BV (subsidiary of J&W Holdings AG - IMR)

10% ZCCM-Investment Holdings Plc (ZCCM)

July 2003

---------------------------------------------------------

ZAMBIA PRIVATISATION AGENCY

PRIVATISATION TRANSACTION SUMMARY SHEETS

Chambishi Acid and Cobalt Plants Together with the Nkana Slag Dumps

SUCCESSFUL BIDDER:

Avmin Limited of South Africa. The transaction was completed in September 1998.

COMMERCIAL TERMS:

a) ZCCM Retained interest 10% (5% free and 5% repayable from dividends)

b) Cash at close US$ 50 m

c) Future cash payment US$ 45 m (Cobalt Price Participation)

d) New Equity Investment US$ 2 m

e) Investment Commitment US$ 70 m

f) Contingent Investment US$ 50 m

MAJOR PROVISIONS OF THE SALE AND PURCHASE AGREEMENT AND THE DEVELOPMENT AGREEMENT

a) Investment Plan:

- Immediate investment, upon completion, of US$ 2 million in the new company as a subordinated shareholder loan, and

- A capital investment commitment of up to US$ 70 million to be expended on modernisation and expansion of the plants within the first five (5) years.

b) Production and Technical Plan:

- Avmin's Business Plan was centred around turning the Nkana Slag Dumps to account by:

i) Investing in state-of-the art smelting technology to produce acid leachable matte, and

ii) Processing the matte through an adapted and expanded Chambishi Cobalt and Acid Plant.

- Production capacity to be increased from 2,5000 to 4,2000 tonnes of cobalt per annum and up to 20,000 tonnes of copper per annum, while leaving that for acid at 60,000 tonnes per annum. Approximately 20,000 tonnes of acid per annum will be consumed internally while the balance will be sold out;

- Apart from treating materials from the slag dumps, the plant would, and is, available to treat cobalt concentrates from Nkana, Nchanga, Luanshya and other operations, including the Konkola North, once it comes on stream;

- The new company would employ 500 people and committed itself to providing suitable training and development programmes to its employees;

- The company was also committed to supporting local businesses and encouraging/facilitating the developments of downstream and allied industries in order to allow for our sourcing of certain functions;

- Commitment to local business development and human resources development programmes;

- recognition of the Mineworkers' Union of Zambia and commitment to provide social services of an acceptable standard;

The Purchaser:

Avmin Limited of South Africa

--------------------------------------------------------

Cunico Resources NV

50% Barry Steinmetz Group Resources Ltd (BSGR)

50% International Mineral Resources (IMR)

part of Kazahk Eurasian National Resources Corp (ENRC.L)

July 1, 2007: Cunico to seek LSE listing

http://www.bsgresources.com/

Más sobre Chambishi Metals Privatisation27: Chambishi Metals Plc (ENRC)

May 13, 2010 - Interim Statement

The acquisition of Chambishi was completed on 6 April 2010, whilst Comit was completed on 11 May

February 18, 2010Acquisition of Chambishi Metals and Comit Resources

Eurasian Natural Resources Corporation PLC - ENRC today announces that it has entered into a conditional agreement to acquire 100% of Enya Holdings BV - Enya which holds a 90% interest in Chambishi Metals PLC, a Zambian copper and cobalt producer, together with a 100% interest in Comit Resources FZE, a Dubai-based marketing and sales company that historically has handled Chambishi’s copper and cobalt sales. The aggregate consideration for the Transaction amounts to US$300 million, which will be wholly funded from ENRC’s existing cash resources. The Transaction remains

subject to the satisfaction or waiver of certain conditions precedent and is expected to be completed no later than the end of June 2010.

Chambishi is a mineral processing facility which produces copper and cobalt. It is the intention of the management of ENRC to combine Chambishi with the Group’s existing operations in the Democratic Republic of the Congo - DRC. ENRC currently plans to invest approximately US$80 million into Chambishi by the end of 2011, in new and upgraded production facilities. The investment should increase Chambishi’s copper production capacity to 55 kt per annum of London Metal Exchange (‘LME’)

The integrated copper and cobalt mining and smelting businesses of Chambishi and those in the DRC, when combined, should have an improved cost position over time.The acquisition also enables ENRC to fast-track its copper and cobalt expansion and to achieve a higher planned level of combined total capacity, of 130 kt per annum of LME Grade A copper cathode and 12 kt per annum of cobalt contained metal salts and concentrates by 2012.

Chambishi’s current facilities comprise a roast leach electro-winning plant - for the processing of oxide concentrate, sulphide concentrate or intermediate metal salts - and an electric arc furnace and a pressure oxidation leach plant for furnace slag treatment. Chambishi also owns a slag dump of approximately 16.6 million tonnes, with an average grade of 1.10% copper and 0.71% cobalt

Current copper production capacity at Chambishi is 25 kt per annum of blister grade copper. Chambishi is also a substantial producer of cobalt, one of the largest in the world, with a current capacity to produce 6 kt per annum of refined cobalt metal. The cobalt metal produced at Chambishi is high-grade and has strong brand recognition in the industry.

OWNERSHIP

10% ZCCM Investment Holdings Plc - ZCCM-IH

90% International Mineral Resources BV - IMR

(subsidiary of Eurasian Natural Resources Corporation Plc)

Eurasian Natural Resources Corporation Plc (LSE:ENRC)

29: Flotation Plant (ChambishiCopperMine NFCA CNMC)

3.2.1.7 Production Capacity

The NFCA concentrator at Chambishi Mine was designed to crush 6,500 tons of ore per day, mill 6,500 tons of ore per day and concentrate 379 tons of copper concentrates per day with a grade of 40%. The concentrator's production recovery is 95.5%. However, the plant is currently operating at half capacity because only about3,500 tons of ore per day are received from the underground operations. The copper concentrate production output is anticipated to improve with increasing ore output from the underground operations.

3.3 Potential Future Developments at Chambishi Mine

NFCA is committed to increasing its investment in Zambia by widening its scope of mineral development. The company intends to undertake the following developments in the future:

Extension of the underground mining rights area to cover a 100 km2 area;

· Increasing mining and processing rates;

· Development of the Chambishi west ore body;

· Development of the Footwall reserves;

· Construction of a sulphuric acid plant;

· Construction of a leach plant for reclamation of copper from low-grade ore;

· Construction of a smelter.

With regard to the reclamation of copper from low-grade ore, it is envisaged that copper will be reclaimed as follows:

Low grade oxide ore from ore stock piles No.'s 3 and 4 will be reclaimed by a process involving heap leaching, solvent extraction, and electro-winning;

· Fine oxide ore from tailings dams No.'s 7, 7A, 8, 9, and 15 will be reclaimed by a process involving agitation, solvent extraction and electro-winning; and

· A process involving heap leaching, solvent extraction and electro-winning will reclaim vat leach tank residue from tailings dam No. 10.

http://www.necz.org.zm/news/comments/eis-reports/NFC%20Mining/NFC%20Mining%20Chambishi%20Copper%20Mine%202.pdf

Tick black line marks border between ENRC and CNMC concessions

Más sobre Flotation Plant (ChambishiCopperMine NFCA CNMC)

Más sobre Flotation Plant (ChambishiCopperMine NFCA CNMC)30: Chambishi Copper Smelter (NFCA CNMC)

Chambishi Copper Smelter whose designed annual capacity is 150 thousand tons of blister copper bears total investment exceeding 310 million USD. The smelter started construction in Nov. 2006 and commenced production by the end of 2008. This project will further improve industrial chain of Chambishi Copper Mine, create nearly 1000 jobs and increase the local export volume by 450 million USD. CNMC’s investment in Zambia has exceeded US$ 400 million.

31: Chambishi Cobalt Plant (ChambishiMetals ENRC)

PRODUCTION & PROCESSING FIGURES

Saleable Cobalt Metal Production 2.038t

OWNERSHIP

February 18, 2010

Acquisition of Chambishi Metals and Comit Resources

Chambishi Metals Plc

CINCI forum Presentation (November 2005)

CINCI forum Presentation (November 2005) page5-7

Más sobre Chambishi Cobalt Plant (ChambishiMetals ENRC)33: Chambishi Iron Age Site

This is open Iron Age site located on the eastern bank of Chambishi Stream just below the new dam. The surface finds of potsherds are still visible.

Más sobre Chambishi Iron Age Site34: Chambishi Open Pit

The open pit has been closed since 1978 but access to the pit is maintained in order to service the ventilation shaft at the eastern end of the base of the pit. The pit dimensions are 1200 m (east to west) by 650 m (north to south) and at its lowest point is approximately 150 m below ground level. The bottom of the pit is used as an access to the underground mine operations.

http://www.necz.org.zm/news/comments/eis-reports/NFC%20Mining/NFCA%20EMP.pdf

Chambishi OP (photo George Maxwell)

Chambishi from the air

Más sobre Chambishi Open Pit36: Sino-Metal & Sino-Acid Chambishi (CNMC)

Sino-Metal Leach Zambia Ltd - SMLZ

Sino-Acid Products Zambia Ltd

PRODUCTION

8.000tpa Cu cathode

April 13, 2010

SMLZ to Mufulira Tailings project

In order to utilize the resources and infrastructure of Chambishi Copper Mine comprehensively , Sino-Metal and Sino- Acid bearing total investment of $25 million was built as an extension of nonferrous metal industrial chain. Chairman Wu Bangguo laid the foundation for this project. Sino-Metal and Sino-Acid commenced production on Sept. 8th, 2006, creating 300 job opportunities to the local people and generating an additional $2million to local government.

OWNERSHIP

Sino-Metal Leach Zambia Ltd

% China Nonferrous Metals Miinnig Co Ltd - CNMC

% Sino-Africa Mining Plc

% NFC Africa Minng Plc

% China Hainan Construction Co Ltd

37: Chambishi South East Deposit

RESOURCE BASE - 2005

69.7Mt at 2.59% Cu (Hitzman et al.)

The orebody has a strike lenght of 8.000m with a max. width/down-dip extent of 2.000m. Average tickness around 5.7m with a maximum of 23m. (Freeman 1988)

Surface project plan of the Copperbelt Orebody Member-hosted orebodies of the Chambishi South East deposit. Fault traces and meter isopachs (black contours) of the Mindola Clastics Formation define the footwall basin geometry. Highest-grade copper mineralization coincides with complex, three-dimensional, subbasin terminations (footwall pinch-outs) and fault zones that controlled Mindola Clastics Formation sedimentation. The central barren gap coincides with a lateral facies change in the Copperbelt Orebody Member from dolomitic siltstone to microbially laminated carbonate atop a basement high.

Source: A New Look at the Geology of the Zambian Copperbelt (Selley et al., 2005)

Othern names:

38: Chambishi UG-Mine (ChambishiCopperMine NFCA CNMC)

RESOURCE BASE

NFC Africa Mining Plc (NFCA)

15% ZCCM Investment Holding Limited (ZCCM-IH)

85% China Nonferrous Metal Mining Co. Ltd (CNMC)

June 29, 1998

Chambishi Copper Mine of Zambia was put into operation in 1965 and was shutdown in July of 1987. The Zambian government issued bidding information to the global in Sept.1996 and CNFC tendered for it in March 1997. Later on Feb.17, 1998 CNFC got the notice of award from the Zambian government. China Nonferrous Metal Africa Mining Industry Co., Ltd. was established in June 29,1998 for development of this mine

Chambishi Mine Development Agreement (June 29, 1998)

Environmental Mangement Plan (June 2006)

Más sobre Chambishi UG-Mine (ChambishiCopperMine NFCA CNMC)39: Chambishi Tailings Project (MFC ChambishiMetals)

Area not defined

RESOURCE BASE - 2/2010

Measured 70% & Indicated 30%

1.6Mt at 1.30% Cu and 0.21% Co

The Company is pleased to advise that Chambishi Metals have now completed an evaluation of the feasibility study, and have provided approval for the project to proceed to development, subject to execution of an operating and marketing agreement acceptable to both parties.

OWNERSHIP

50 % Metals Finance Ltd - MFC

50% % Metals Finance Africa Pty Ltd - MFA

(50/50 subsidiary of Metals Finance Ltd - MFC and Muva Metals (RSA) Ltd - Muva

43: TD6 - Chambishi (NFCA CNMC)

Tailings Dam 6 is a pollution control facility used to clarify effluent from both the NFCA and Chambishi Metals plc operations. The effluent is transported from the NFCA mine site and the Chambishi Metals plc site via a series of open drains that empty into one main canal leading to the TD 6 inlet.

Originally, the Chambishi stream, which ran through the Chambishi Mine site, was diverted so that it would carry effluent from the mine site to TD 6. In case of floods, provision has been made to bypass flood flows so that only part of the discharge is diverted onto the dump whilst the remainder is routed in a channel around the dump to rejoin the diverted Chambishi stream at the TD 6 decant outlet. Effluent from the TD 6 outlet is discharged to the New Dam, which in turn discharges into the Chambishi stream.

http://www.necz.org.zm/news/comments/eis-reports/NFC%20Mining/NFCA%20EMP.pdf

Más sobre TD6 - Chambishi (NFCA CNMC)44: TD 7, 7A, 8, 9 - Chambishi (NFCA CNMC)

June 24, 2010

CSU Marches into Zambia for Tailings Exploitation

The Central South University inked agreement with Zambia's Ministry of Mining Industry & Mineral Products Exploitation on the morning of June 23 in Changsha, and both sides are to conduct comprehensive collaboration. Maxwell, minister of the Ministry of Mining Industry & Mineral Products of Zambia, Gao Wenbing, secretary of the Party Committee of the Central South University, and Huang Boyun, president of the university, attended the signing ceremony.

As the fourth biggest state in copper production in the world, Zambia's accumulative tailings amounted to several billion tons, causing not only heavy metal pollution but also huge waste containing several million tons of copper. The Central South University takes the lead in biological copper extraction in the world, and its technology in this field can improve the copper extraction rate from the tailings for Zambia by over 30%.

With the technological support of the Central South University, the used-to-be "burden of Zambia" may be transformed into a treasure to safeguard the resource security of China.

According to the agreement, the Central South University will provide technological support to Zambia in terms of fully utilizing the tailings, solving the environmental problems and tapping mineral sources, and cultivate local senior talents for the state.

Fine oxide ore from tailings dams No.'s 7, 7A, 8, 9, and 15 will be reclaimed by a process involving agitation, solvent extraction and electro-winning

Más sobre TD 7, 7A, 8, 9 - Chambishi (NFCA CNMC)45: TD10 - Chambishi (NFCA CNMC)

A process involving heap leaching, solvent extraction and electro-winning will reclaim vat leach tank residue from tailings dam No. 10.

Más sobre TD10 - Chambishi (NFCA CNMC)47: TD15 - Chambishi (NFCA CNMC)

Fine oxide ore from tailings dams No.'s 7, 7A, 8, 9, and 15 will be reclaimed by a process involving agitation, solvent extraction and electro-winning

Más sobre TD15 - Chambishi (NFCA CNMC)48: TD16 Luano / Chambishi (NFCA CNMC)

Luano Tailings Dam (TD 16) is situated to the north west of the Chambishi Open Pit and the Plant Area. It consists of an earthfill cross-valley main embankment which impounds most of the tailings and a smaller paddock in the north -eastern corner, cut off from the main depository by an earthfill bund wall, where oxide tailings are stored. The TD is a classified, decommissioned dam at which deposition ceased in 1989/90 following the commissioning of the Musakashi Tailings Dam to which the tailings from the NFCA concentrator are being sent. A coffer dam has been constructed within the Luano Tailings Facility to contain tailings should an emergency situation arise.

Más sobre TD16 Luano / Chambishi (NFCA CNMC)49: TD19 Musakashi / Chambishi (NFCA CNMC)

The Musakashi Tailings Dam (TD 19) is an active, classified dump situated about 10 km north of the Plant Area. It consists of an earthfill embankment which was 360 m long and 15.5 m high

since 1996. The dam is due to be extended in two phases, so as to increase its tailings containment capacity. During the first phase, which is on-going, the embankment wall is being extended to 700 m long, and to 21.5 m high. During the second phase of extension the dam, the height of the dam will be extended by a further 4 metres to 25.5 metres. The crest width is 3m. The TD was originally designed to have a capacity of 5.7 million tonnes, but provisions were made to raise the embankment to increase storage capacity to 23 million tonnes of material. The tailings dam receives tailings from the concentrator at the NFCA mine site, and the tailings are transported to the dam through a refurbished tailings pipeline

Más sobre TD19 Musakashi / Chambishi (NFCA CNMC)54: Chayinda Au (ZRL)

Chayinda was discovered in 1934 when pitting and trenching by Rhodesia Minerals Concessions Ltd (RST) returned up to 62.9g/t Au. In 1960, RST conducted geological mapping, geochemical sampling and magnetic and radiometric surveying. Trenching showed mineralisation to be thin, with intervals up to 0.6m averaging 2.12g/t Au. In 1976, the Zambian Ministry of Mines conducted mapping, panning,magnetic and gravity surveying, soil sampling, trenching and pitting. Eleven vertical diamond drillholes were completed for a total of 544m. Samples were analysed by atomic absorption spectrometry (AAS) methods. The work led to the estimation of “proven reserves” of 79,300t averaging 5g/t Au plus a “probable reserve” of 77,600t averaging 5g/t Au.

Zambezi Resources (ASX:ZRL)

Hole CHYRC0003

674148mE, 8308166mN

-15° 17' 49.45", +28° 37' 18.9

Más sobre Chayinda Au (ZRL)55: Cheowa Cu-Au (ZRL)

RESOURCE BASE

Historic 6.5Mt at 1.13% Cu, 0.30gr/t Au

Inferred as at Dec 2007: 2.9Mt* at 1.05% Cu and 0.22g/t Au

* on CC2: 1.2km strike of 13km total

PFS to be completed around June 2008

52nd Minesite Presentation May 2008 (slides 3-5)

Cheowa Copper JV

49% Zambezi Resources Ltd

51% Glencore International AG

(51% after US$10M, 71% on BFS or additional US$10M)

HISTORY

The first documented exploration of the Cheowa and Neningombwe prospects was by RMCC, which completed regional mapping in the early 1930’s. Exploration within the Cheowa shear zone is reported by later investigators, although details of this work are currently unavailable. In the 1960’s, Charteredex completed drainage and soil sampling surveys, sampling of old workings,geophysical surveying, trenching, and a programme of 11 diamond drillholes (Figure 8). Soil sampling defined an anomaly of greater than 200ppm Cu approximately 300m in width and extending for 14km along the shear zone. Sampling of RMCC shaft and adit cross-cuts returned up to 2.0% Cu over 3.7m and 2.2% Cu over 5.4m. Gold values varied from trace to 3.75g/t Au. At Neningombwe, narrow mineralisation exposed within adits included up to 0.34m averaging 6.0% Cu with gold up to 0.9m averaging 9.9g/t Au.Trench sampling over soil anomalies at Cheowa and Neningombwe identified up to 13.7m averaging 1.12% Cu and 3.8m averaging 1.11% Cu, respectively. Diamond drilling was completed at the Cheowa prospect with a best intersection of 2.96m averaging 5.41% Cu from 70m depth. Selective gold assaying of core containing in excess of 1% copper showed a maximum of 0.48m averaging 7.78g/t Au. Mineralisation was reported to remain open at depth

Cheowa Deposit

Cheowa Resources Zambia Ltd

100% subsidiary of Cape Resources Bermuda Ltd

100% subsidiary of Zambezi Resources Ltd

Position calculated from

UTM Zone 35S (WGS84)

730000mE, 8266000mN

-15° 40' 25.11", +29° 8' 44.96"

Más sobre Cheowa Cu-Au (ZRL)56: Chibuluma Privatisation (Metorex)

Chibuluma Mine

15% ZCCM-Investment Holdings Plc (ZCCM)

85% Metorex Ltd

ZAMBIA PRIVATISATION AGENCY

PRIVATISATION TRANSACTION SUMMARY SHEETS

BIDS RECEIVED :

Chibuluma Mine was initially advertised for sale as part of Package "A" comprising Nkana and Nchanga Divisions. However, bidders were allowed to bid for either part or whole of each package.

At bid closing, 28 February 1997, two bids were received for Chibuluma Mine from the following bidding groups:

- The Kafue Consortium comprising:

Avmin Limited, Noranda, Phelps Dodge and Commonwealth Development Corporation. The Consortium wanted Chibuluma Mine to remain as part of Package "A" which they had bid for.

- The Metorex Consortium comprising: Crew Development Corporation, a Canadian Development Company; Genbel Limited (formerly Randex Limited), a mining finance company; and Metorex (Pty) Limited and Maranda Mines Limited, South African junior mining companies.

The Kafue Consortium did not make a separate offer for Chibuluma but wanted it retained within Package "A".

The offer accepted by the GRZ/ZCCM Privatisation Negotiating Team for Chibuluma, following the negotiations with the Metorex Consortium, was as follows:

Description Revised offer

25 July 1997

Cash at Close US$17.5 m

Copper price participation (NPV) US$1.2 m

Cobalt price participation (NPV) US$6.4 m

Committed capital expenditure US$34 m

ZCCM retained interest (all free carried) 15%

SUCCESSFUL BIDDER:

Metorex Consortium, comprising Metorex (Pty) Limited and Maranda Mines Limited, both South African junior mining companies; Crew Development Corporation, a Canadian development company; and Genbel Limited (formerly Randex Limited), a mining finance company of Australia. The transaction was completed in October 1997.

COMMERCIAL TERMS:

a) ZCCM retained interest (all free carried) 15%

b) Cash consideration at Close US$17.5 m

c) Copper price participation (NPV) US$ 1.2 m

d) Cobalt price participation (NPV) US$ 6.4 m

e) committed capital expenditure US$ 34.0 m

MAJOR PROVISIONS OF THE SALE AND PURCHASE AGREEMENT AND THE DEVELOPMENT AGREEMENT

- The business plan, which formed part of the sale transaction through the Development Agreement, included the following aspects:

- Efficient utilisation of mineral resources through the development of Chibuluma South;

- A minimum investment commitment of US $34 million for the first three (3) years:

- Commitment to immediately start developing the Chibuluma South Mine to phase in with the closure of Chibuluma West Mine, anticipated in 3 to 4 years time.

- The Consortium's plan to immediately and unconditionally develop the Chibuluma South deposit was considered important as it would avert a major retrenchment of Chibuluma west employees when the operations of this mine were to close in three to four years time;

- A commitment to support local business development;

- New company to list on the Lusaka Stock Exchange in 2 years time;

- A commitment to provide Zambian professionals with employment, training and development opportunities;

- Recognition of the union and a commitment to provide social services at a standard not worse than that at the time of take over.

Más sobre Chibuluma Privatisation (Metorex)57: Chibuluma Shafts ?1 and ?2

Deposit type: Footwall Quartzite Hosted Mineralisation (Type 1b)

Copper mineralisation is hosted by quartzite in the footwall of the OS1 Member at the Chingola ‘B’, Mwambashi ‘B’ (Mwambashi Copper Project), Chibuluma, Fitula and Mimbula mines. The host units are located in fault bounded sub-basins to which the overlying shale has acted as an impermeable barrier and reductant for mineralised fluids. It has been postulated that hydrocarbons trapped in the arenaceous footwall sediments may also have acted as reductants that have controlled precipitation of sulphide minerals from mineralised fluids. Whilst having smaller resources than the ore shale deposits, typically several tens of millions tonnes, the grades are generally higher at 2.5% to 4% Cu, with varying Co grades.

How they beat the flood at Chibuluma (1966)

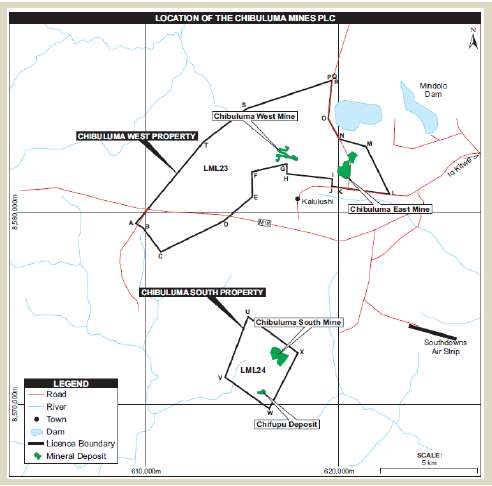

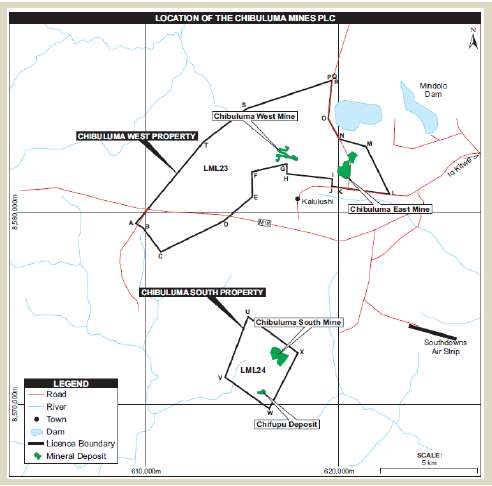

http://www.nrzam.org.uk/Mining/ChibulumaMine/ChibMine.html60: Chibuluma West UG-Mine [closed] (Metorex)

RESOURCE BASE - CHIBULUMA WEST

5.6Mt at 3.33% Cu & 0.2% Co

15.000tpa Cu at C3 Cost of $ 2.504/t

The Chibuluma Mine complex is situated near the town of Kalulushi, which is approximately 12 km west of the Kitwe, one of the metropolitan and industrial centres of the Zambian Copperbelt. The current mining area is Chibuluma South, some 13 km from the town of Kalulushi.

The topography is generally flat, with elevations above mean sea level of 1 220m to 1 300m at Kalulushi. As with the rest of the Zambian Copperbelt, the weather is tropical with the rains occurring in summer, and are particularly heavy in April. Potable water is supplied to the town of Kalulushi.

Electricity is readily available on the Copperbelt, and supplied by Copperbelt Energy Corporation to the mine and town. The Copperbelt itself is well supported by road, rail and air services. An international airport at Ndola, an hour's drive from Kitwe, services the Copperbelt.

The main road links are all tarred, and Kitwe and the Chibuluma Mines are linked by rail to the Zambian rail network as well as to the countries to the south of Zambia. Copper from the smelters and refineries on the Copperbelt is exported mainly through Durban in South Africa, however other links exist to both Tanzania and Mozambique. This infrastructure has been in place since the early days of the copper mining industry.

HISTORY

Chibuluma Mine began production in 1955 as a self-contained unit producing copper concentrates, which were treated at the Mine concentrator. However the concentrator was closed in 1991 and the ore has been treated locally. The Chibuluma South deposit was discovered in 1969.

The Copperbelt Mines were nationalised and merged into Zambia Consolidated Copper Mines (ZCCM) in 1982. Subsequently, Chibuluma was the first mine to be privatised, being acquired by a Metorex consortium in October 1997 with ZCCM/Zambian Government retaining a 15% interest. Chibuluma South is the first new underground mine to open on the Zambian Copperbelt in 30 years.

The town of Kalulushi was developed to support Chibuluma Mines in the early 1950's. When the Chibuluma East mine was closed, the excess housing and facilities became available for use by ZCCM corporate and technical officials. The town of Kalulushi thus houses a number of ZCCM corporate divisions, and on the privatisation of ZCCM, many of these employees purchased the houses they resided in and still continue to live in the area.

Kalulushi is a mining village with approximately 3 300 houses, situated some 12 km west of Kitwe, the principal town on the Copperbelt, was developed to support Chibuluma Mines. It has its own recreation club, golf course, hospital, school and clinic as well as a small shopping facility, and the town is accessed by a tar road from Kitwe. The town is supplied with electricity by ZESCO and receives a potable water supply from Kitwe. Kalulushi has its own sewerage works and internal water reticulation. It is linked into National Zamtel telephone network.

OWNERSHIP - LML 23 & LML 24

Chibuluma Mines Plc*

15% ZCCM Investment Holdings Plc

85% Metorex Ltd

*Chibuluma South (active) & Chibuluma West and East (closed)

Status January 1, 2010

Más sobre Chibuluma West UG-Mine [closed] (Metorex)

Más sobre Chibuluma West UG-Mine [closed] (Metorex)61: Chibuluma South UG-Mine (Metorex)

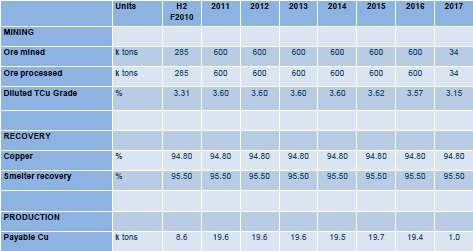

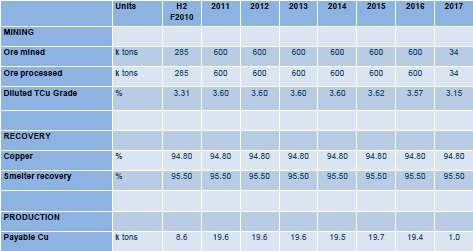

RESOURCE BASE

Reserve 8Mt at 3.6% Cu

Inferred 1.5Mt 2.9% Cu

Date

Chibuluma LOM

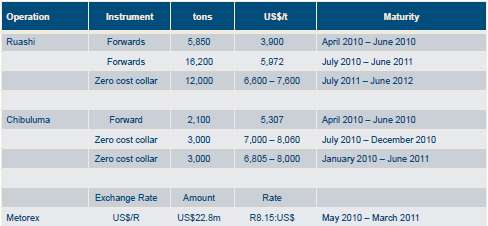

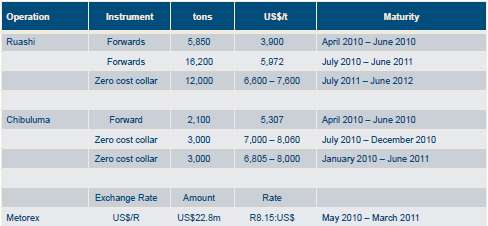

Metorex Hedging and Risk Management

May 26, 2010 - Presentation (54 slides pdf)

------------------------------------------------------------

OWNERSHIP

LML 23 & LML 24

Chibuluma Mines Plc*

15% ZCCM Investment Holdings Plc

85% Metorex Ltd

*Chibuluma South (active) & Chibuluma West and East (closed)

Status January 1, 2010

Metorex Ltd (JSE:MTX)

ARCHIVE

Weatherly Plc is tolling the concentrate at Tsumeb Namibia

Más sobre Chibuluma South UG-Mine (Metorex)68: Chimwami Tin

Area

Other names: Chisuki, Kalela, Masuku, Chisuki

-17° 24' 3.71", +26° 59' 2.02"

Más sobre Chimwami Tin69: Chimiwungo Pit (Equinox)

RESOURCE BASE - CHIMIWUNGO

Proved: 81.5Mt at 0.70% Cu

Probable: 118.7Mt at 0.57% Cu

Inferred: 413Mt at 0.60% Cu

Lumwana Project (LML49)

100% Equinox Minerals Ltd (ASX:EQN, TSX:EQN)

Position calculated from

UTM Zone 35S (WGS84)

377925mE, 8641750mN

-12° 17' 3.62", +25° 52' 38.90"

Más sobre Chimiwungo Pit (Equinox)71: Chingola Open Pit "A"

Other names: Block A

Resource base:

Chingola "ACE" combined

Inferred: 35.56Mt at 1.54% Cu, 0.99AsCu

4.2.5 Other Satellite Deposits

Table 4-8 below shows the satellite pits resources in August 2005 owned by KCM but not included in the its LOM plan, which were based on an optimised US$1.00 per lb pit shell. These resources for Mimbula and Chingola Open Pit - ACE were based on alternative treatment options not practiced by KCM (ie heap leach) and had been classified as Inferred due to low geological confidence in the data used. Until a viable process method has been verified these resources can only be considered as future upside potential.

Más sobre Chingola Open Pit "A"72: Chingola Open Pit "B"

GEOLOGICAL MAP OF THE NCHANGA AREA

DISTRIBUTION OF MINERALIZATION AT CHINGOLA B

Source: Origin of the Nchanga copper–cobalt deposits of the Zambian Copperbelt

Más sobre Chingola Open Pit "B"73: Chingola Open Pit "C"

Other names: COP 'C'

RESOURCE BASE

Chingola "ACE" combined

Inferred: 35.56Mt at 1.54% Cu, 0.99AsCu

4.2.5 Other Satellite Deposits

Table 4-8 below shows the satellite pits resources in August 2005 owned by KCM but not included in the its LOM plan, which were based on an optimised US$1.00 per lb pit shell. These resources for Mimbula and Chingola Open Pit - ACE were based on alternative treatment options not practiced by KCM (ie heap leach) and had been classified as Inferred due to low geological confidence in the data used. Until a viable process method has been verified these resources can only be considered as future upside potential.

Más sobre Chingola Open Pit "C"74: Chingola Open Pit "D"

Other names: COP 'D'

RESOURCE BASE

Chingola Open Pits D & F combined (COP D & F)

Probable 20.17Mt at 1.75% Cu, 0.45% AsCu

Measured 0.09Mt at 1.49% Cu, 0.61% AsCu

Indicated 3.16Mt at 2.19% Cu, 0.88% AsCu

Inferred 82.41Mt at 1.34% Cu, 0.84% As Cu

4.2.3 Chingola Open Pit

Chingola Open Pit (COP) areas D and F are structurally simple with consistent orebody thickness and good spatial grade continuity along strike and dip. The two parts of the COP D and F pit are separated by a barren zone representing a topographic high or reef facies.

75: Chingola Open Pit "E"

RESOURCE BASE - Chingola "ACE" combined

Inferred 35.56Mt at 1.54% Cu, 0.99AsCu

4.2.5 Other Satellite Deposits

Table 4-8 below shows the satellite pits resources in August 2005 owned by KCM but not included in the its LOM plan, which were based on an optimised US$1.00 per lb pit shell. These resources for Mimbula and Chingola Open Pit - ACE were based on alternative treatment options not practiced by KCM (ie heap leach) and had been classified as Inferred due to low geological confidence in the data used. Until a viable process method has been verified these resources can only be considered as future upside potential.

Other names: Block E, COP 'E', Chingola E Open Pit

76: Chingola Open Pit "F"

Other names: COP 'F'

RESOURCE BASE

Chingola Open Pits D & F combined (COP D & F)

Probable 20.17Mt at 1.75% Cu, 0.45% AsCu

Measured 0.09Mt at 1.49% Cu, 0.61% AsCu

Indicated 3.16Mt at 2.19% Cu, 0.88% AsCu

Inferred 82.41Mt at 1.34% Cu, 0.84% As Cu

4.2.3 Chingola Open Pit

Chingola Open Pit (COP) areas D and F are structurally simple with consistent orebody thickness and good spatial grade continuity along strike and dip. The two parts of the COP D and F pit are separated by a barren zone representing a topographic high or reef facies.

Más sobre Chingola Open Pit "F"78: OB4/OB6 - Chingola

Chingola Overburden Dump 4 & 6

Chingola refractory ore

Treatment of Chingola Refractory Ores - Sikamo et al.

Más sobre OB4/OB6 - Chingola80: OB7 - Mimbula / Chingola (Rephidim - Zambezi Resources)

Overburden Dump 7

RESOURCE BASE

Mimbula & Fitula dumps combined

6Mt at +1% Cu

Like other copper dumps in the region, these dumps have not previously been treated, but were formed by removal and discarding of the supergene oxide cap from the underlying primary sulphide orebody, together with waste rock from KCM’s mining operations. KCM mine records indicate that a total of approximately 6 million tonnes of material has been disposed of in the Mimbula and Fitula dumps, with an average grade exceeding 1% copper (resulting in approximately 60,000 tonnes of contained copper in the dumps).

July 15, 2010 - Drilling program on OB18, SP11 & OB7 completed

• RC drilling and surveying of copper mineralized rock dumps at Chingola completed

• Visual evidence of copper oxides and sulphides mineralisation

• Total of 1864 m drilled and sampled

• Prepared samples being transported to Australia for assay

• Proceeding towards decision point regarding project acquisition and the feasibility studies into SX – EW copper cathode operation

April 7, 2010 - Zambezi Resources Ltd Signs MOU

Project Area: OB18, SP11 and OB7

---------------------------------------------------------

OWNERSHIP

Rephidim Mining and Technical Supplies of Zambia Ltd,

holds the Mimbula dump and the rights to acquire the Fitula dump.

December 12, 2007 - WRL Option

(Lapsed on March 31, 2008)

49% Rephidim Enterprises (Zambia) Ltd

51% Washington Resources (ASX.WRL)

Más sobre OB7 - Mimbula / Chingola (Rephidim - Zambezi Resources)82: OB9 - Fitula / Chingola (Rephidim)

Overburden Dump 9

Resource base:

Mimbula & Fitula dumps combined

6Mt at +1% Cu

Like other copper dumps in the region, these dumps have not previously been treated, but were formed by removal and discarding of the supergene oxide cap from the underlying primary sulphide orebody, together with waste rock from KCM’s mining operations. KCM mine records indicate that a total of approximately 6 million tonnes of material has been disposed of in the Mimbula and Fitula dumps, with an average grade exceeding 1% copper (resulting in approximately 60,000 tonnes of contained copper in the dumps).

---------------------------------------------------------

Rephidim Enterprises (Zambia) Limited,

holds the Mimbula dump and the rights to acquire the Fitula dump.

Más sobre OB9 - Fitula / Chingola (Rephidim)83: OB10 - Fitula / Chingola

Overburden Dump 10

Rephidim Enterprises (Zambia) Limited,

holds the Mimbula dump and the rights to acquire the Fitula dump.

Más sobre OB10 - Fitula / Chingola84: OB11 - Fitula / Chingola

Overburden Dump 11

Rephidim Enterprises (Zambia) Limited,

holds the Mimbula dump and the rights to acquire the Fitula dump.

Más sobre OB11 - Fitula / Chingola85: OB13 - Fitula / Chingola

Overburden Dump 13

Rephidim Enterprises (Zambia) Limited,

holds the Mimbula dump and the rights to acquire the Fitula dump.

Más sobre OB13 - Fitula / Chingola88: OB18 Luano / Chingola

Overburden Dump 18 'Luano'

July 15, 2010 - Chingola copper dumps project

The largest rock dump at Luano, OB18, comprises mineralized overburden of the Lower Roan Group sediments which comprise mineralized arkose sandstones, grits and schists. Given the synclinal nature of the ore bodies that were stripped, and the pervasive nature of the copper mineralisation throughout the stratigraphy, there is extensive oxide copper mineralization in the overburden dump. Visual inspection of the rocks comprising the dump confirms the presence of copper oxide minerals including extensive malachite as the dominant copper mineral and chalcocite as the sulphide coppermineral.

http://www.zambeziresources.com/_content/documents/811.pdf90: OB20/OB2/OB 22 - Chingola

Overburden Dumps 20, 2 & 22

RESOURCE BASE

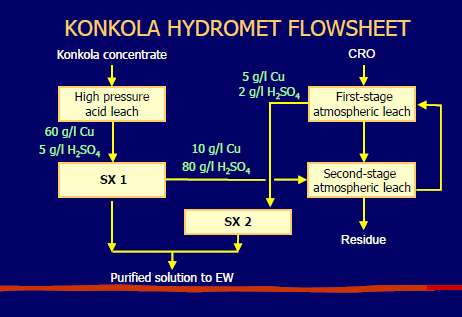

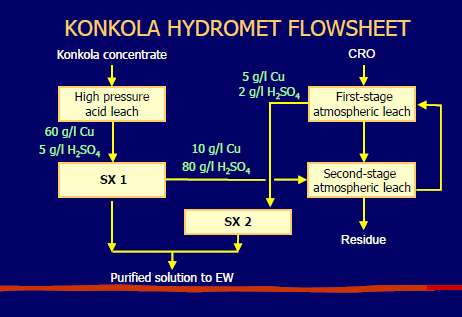

TOTAL CRO - CHINGOLA REFRACTORY ORE

Indicated 150.84Mt at 0.87% Cu, 0.60% AsCu

Inferred 2.27Mt at 0.62% Cu

REFRACTORY ORE PROCESSING STUDIES

Anglo American Presentation on CRO - Chingola Refractory Ore (2001)

Processing of Konkola copper concentrates and Chingola refractory ore in a fully integrated hydrometallurgical pilot plant circuit (December 2001)

Más sobre OB20/OB2/OB 22 - Chingola92: TD2 - Chingola

Tailings Dam 2

RESOURCE BASE

Probable Reserve: 5.52Mt at 0.74% Cu, 0.55% AsCu

4.2.6 Tailings Dams

As of August 2005, the Tailings Dams (TD) at Nchanga were being processed at the nearby Tailings Leach Plant (TLP). They comprised relatively coarse tailings residue arising from the treatment of ROM copper ore at the Nchanga concentrator dating from 1964. The remaining dumps were TD2, TD3 and TD4, which were established in 1964, 1974 and 1972 respectively.

The database for the Tailings Dams as of August 2005 included the results of drilling and test pit campaigns undertaken between 1976 and 1990 and later in 2000. The results of this work form the basis of the August 2005 estimate.

Más sobre TD2 - Chingola93: TD3 - Chingola (KCM Vedanta)

Tailings Dam 3

PRODUCTION - RECLAMATION PROJECT

24Ktpa Cu between 2010-2025

RESOURCE BASE - TD3 & TD4 COMBINED

Proved Reserve: 70.90Mt at 0.68% Cu, 0.47% AsCu & 0.02% Co

October 8, 2009

Mr Kumar said KCM had employed 100 more workers to operate the reclamation project at TD3. "When the Fitwaola Mine is re-opened, we shall create more jobs because we are looking at engaging 300 employees to work there, so jobs will be created at the mine,"Mr Kumar said.

He said they expected to produce 2000 tonnes of cop a month from the reclamation project at TD3. Meanwhile, Mr Kumar said KCM has pumped $10 million into the reclamation project at TD3.

He said reclamation was the cheapest way of extracting copper but that the project would help in sustaining the running of the mines. The project at TD3 was expected to run for 15 years and that they had re-opened TD3 in advance because the current one would run out in the next two years.

4.2.6 Tailings Dams

As of August 2005, the Tailings Dams (TD) at Nchanga were being processed at the nearby Tailings Leach Plant (TLP). They comprised relatively coarse tailings residue arising from the treatment of ROM copper ore at the Nchanga concentrator dating from 1964. The remaining dumps were TD2, TD3 and TD4, which were established in 1964, 1974 and 1972 respectively.

The database for the Tailings Dams as of August 2005 included the results of drilling and test pit campaigns undertaken between 1976 and 1990 and later in 2000. The results of this work form the basis of the August 2005 estimate.

http://www.zci.lu/KCM%20Valuation%20Report.pdf

Más sobre TD3 - Chingola (KCM Vedanta)94: TD4 - Chingola

Tailings Dam 4

Resource base:

TD3 & TD4 combined

Proved Reserve: 70.90Mt at 0.68% Cu, 0.47% AsCu & 0.02% Co

4.2.6 Tailings Dams

As of August 2005, the Tailings Dams (TD) at Nchanga were being processed at the nearby Tailings Leach Plant (TLP). They comprised relatively coarse tailings residue arising from the treatment of ROM copper ore at the Nchanga concentrator dating from 1964. The remaining dumps were TD2, TD3 and TD4, which were established in 1964, 1974 and 1972 respectively.

The database for the Tailings Dams as of August 2005 included the results of drilling and test pit campaigns undertaken between 1976 and 1990 and later in 2000. The results of this work form the basis of the August 2005 estimate.

Más sobre TD4 - Chingola95: TD7 - Chingola (FraserAlexander KCM Vedanta)

Tailings Dam 7

Fraser Alexander™s tailings operations in Zambia are based in Chingola, where various hydro-sluicing projects are operated for Konkola Copper Mine. Initially, the mine only used the TD2 tailings dam as a deposition facility for its copper tailings, while the runoff water ran into the pollution control dam (PCD). Since the dam was proving to be inadequate to handle the tailings volumes, further dams were built.

Fraser Alexander was asked to put together a plan to re-mine the TD7 tailings dam, which was implemented within three weeks, an aspect which gave us the edge over our competitors with regard to delivery time. The high-pressure water pumps and slurry pumps were installed within three days.

Currently 10 000 tons of tailings are pumped from TD7 per day, amounting to 300 000 tons per month.

A new approach was suggested for the removal of slime from the PCD, which was not producing the required volumes. The installation of a barge with a new pump and the use of the latest hydro-sluicing equipment have improved the recovery of slime from the PCD to such an extent that the dam has surpassed its target beyond expectation.

Based on Fraser Alexander’s successes with the Konkola tailings dams, the mine requested that the company establish re-mining solutions for TD3a and 3b. All the planning has been completed to start operations in February 2009. The last phase will involve implementation of the TD5 re-mining solution. The next step is the implementation of an overall maintenance plan for the entire tailings site.

The Konkola project has been characterised by exceptional delivery times, good working relationships and transparency in all communications. We believe that our approach has proven that Fraser Alexander has the cutting edge expertise to provide an innovative solution to any tailings challenge.

Más sobre TD7 - Chingola (FraserAlexander KCM Vedanta)

Más sobre TD7 - Chingola (FraserAlexander KCM Vedanta)97: Chisawa Cu (ZRL)

Update April 30, 2010

Assaying of a significant backlog of drill samples from Kangalui and Chisawa projects from the last field season’s work program commenced during the quarter and interpretation of the assay work is underway. The results of this work will be reported when the geological analysis and data validation is completed in the next few months. This work may produce an initial JORC compliant resource estimate for this project.

August 20, 2008

Commenting on the announcement, Julian Ford, Managing Director of Zambezi Resources, said:

“These excellent drill results from Chisawa over a 2km strike length confirm our opinion that the Kangaluwi Copper Project has the potential to develop as a world-class copper asset and a company-making project..."

New RC drillhole intercepts from Chisawa include: 14m at 1.52% copper, 12m at 1.36% copper, 10m at 1.23% copper, and 14m at 0.65% (Table 1, Figs 1, 2 and 3). Further assays are awaited to confirm strong zones of visual mineralisation observed in drilling. The mineralised zone remains open down dip and along strike to the east and west.

Mineralisation at Chisawa consists of chalcopyrite, bornite, malachite, azurite and secondary chrysocolla in the oxide zone. The host sequence consists of sheared metasediments, metavolcanics and a late stage, conformable coarse grained felsic pegmatite. Mineralisation is hosted within strongly foliated garnet-quartz-biotite-muscovite schist and feldspar-quartz-muscovite-kyanite pegmatite. Mineralisation dips moderately to the south west at approximately 30-40o and occurs within the sheared southern limb of an overturned ESE-plunging regional synformal fold.

Initial drilling at Chisawa targeted surface malachite mineralisation coincident with a >250ppm copper in soils geochemical anomaly over a north west – south east trending strike length of 7.2km. The significant results reported here come from the core of this anomaly which consists of a 3.1km strike length at >1000ppm copper in soils. The soil geochemistry conforms to a mapped and interpreted lithological and structural corridor. A strong correlation between the >1000ppm Cu contour and higher grade copper mineralisation is evident in the RC drilling. Drill testing of this zone to date is via widely spaced drill sections with a nominal distance between sections of 200-400m.

The greater Kangaluwi project covers in excess of 28km of strike length (see Fig 1) and detailed drilling has tested only approximately 3.5km strike length to date at Kangaluwi. At the neighbouring Chisawa prospect, drilling has sparsely tested only approximately 3.5km strike length. 75% of the estimated total prospective strike length of the greater Kangaluwi project remains to be drill tested.

Kangaluwi Copper Project

Más sobre Chisawa Cu (ZRL)98: Chisebuka U3O8 (AFR)

March 11, 2008

The new results confirm the discovery of significant grades and thicknesses of sandstone-type uranium mineralisation. Mineralisation is near surface and likely to be amenable to open pit extraction.

Two parallel mineralised zones have been identified, with strike lengths of up to 800m. Both zones remain open along strike. Additional RC drilling is scheduled to commence in the second quarter of 2008, after the seasonal rains have ceased.

African Energy Resources Ltd (ASX:AFR)

Albidon Ltd (ASX:ALB, AIM:ALD)

Drillhole CHI007:

Position calculated from:

UTM Zone 35S (WGS84)

606780mE, 8159562mN

-16° 38' 38.32", +28° 0' 4.50"

Más sobre Chisebuka U3O8 (AFR)99: Chisuki Tin

Area?

Chisuki: Mica, Tin, Tantalum

Tin, together with tantalum, was being mined on an irregular basis by small-scale workers from the Tin Belt of southern Zambia, east of Choma. Tin occurs as cassiterite in pegmatites and in placers. Stanniferous quartz-muscovite-feldspar-tourmaline pegmatites intruding schistose metasediments occur over a strike length of 100km centred on Masuku Mission and approximately 150 separate occurrences have been recorded. The average annual production was around 10t of tin-tantalum concentrate and was sold as such to local processors.

516009mE, 8098198mN

-17° 12' 3.76", +27° 9' 2.04"

Más sobre Chisuki Tin101: Chiwanda Zinc (Vale/ARM)

Area

RESOURCE BASE - HISTORIC

87Kt at 1.87% Zn (Freeman)

After 1970 ZamAnglo shifted its focus to the Lukali and Chiwanda areas. In the case of the latter area, ZamAnglo identified a 450m long, NE trending Zn-Pb soil anomaly and focussed efforts on a small >2000ppm Zn anomaly located in the western portion of the broader soil anomaly

Kabwe Mine (PLLS 28)

[TEAL Exploration & Mining Inc]

Other names: Chiwenda

Más sobre Chiwanda Zinc (Vale/ARM)102: Chiwefwe manganese (Red Rock)

RESOURCE BASE - 8/2006

Indicated: 2.36Mt at +46% Mn

Historic Production:

81.000t at 45% Mn between 1954 and 1963

Gypsum Industries Ltd

Early 2007 we began mapping and sampling at our 400 hectare manganese project at Chiwefwe, near Mkushi in Zambia. This was followed by a 15 hole shallow RAB drill programme to test for good grade mineralisation extending to depth. The results enhanced our understanding of the deposit, and some holes ended in mineralisation. The grades encountered were variable, as were those from a sampling programme on the several thousand tons contained in old stockpiles on site. A scoping study was carried out by CSA Consultants Ltd ("CSA"), which concluded that production was likely to be practicable and economic, provided that reliance could be placed on the assumptions made on tonnage and grade.

Más sobre Chiwefwe manganese (Red Rock)104: Chiyobe

Area not defined

514235mE, 80945512mN

-17° 14' 3.75", +27° 8' 2.04"

Más sobre Chiyobe105: Chongwe South Cu (ZRL)

Area

Chongwe South consists of the Lucky Jim, Kanakantapa, A, B & C lenses

Historic Reserve base:

1.55Mt at 1.55% Cu Sulphides

0.55Mt at 1.62% Cu Oxides

History:

The first reported exploration of the Chongwe South deposits is by Chartedex in 1962. The Lucky Jim and Kanakantapa Prospects were detected in systematic soil geochemistry surveying and electrical 57 geophysical and magnetic surveys undertaken. Drill testing of oxide mineralisation returned results from 1.5m averaging 1.30% Cu to 4.3m averaging 2.40% Cu over a strike length of 290m. On-going programmes of detailed geochemical and geophysical surveys extended the zone of mineralisation and located the Porcupine and Robuko prospects (subsequently referred to as the ‘A’ and ‘B’ Lenses). By 1972, exploration has identified “reserves” at the various prospects totalling 1.55Mt averaging 1.55% Cu as sulphide mineralisation (1% Cu cutoff grade), and a further 0.55Mt averaging 1.62% Cu in oxide mineralisation (0.4% Cu cutoff grade).

Mulofwe Project (PL219) Chongwe Copper Belt

Zambezi Resources (ASX:ZRL)

681150mE, 8307700mN

-15° 18' 2.87", +28° 41' 13.81"

Más sobre Chongwe South Cu (ZRL)107: Chumbwe - Oryx U3O8 (Axmin)

Davidite discovered in abundance at surface, assaying +5% U308

1600m of trenching completed, mineralisation to 1500ppm U308 over widths to 50m

Preliminary metallurgy shows ~70% recovery in acid leach testwork

--------------------------------------------------------------

OWNERSHIP*

Uranium Rights Joint Venture (Chumbwe, Mpande, Mulungushi and Rufunsa)

Southern African Resources Ltd and Oryx (Bermuda) Ltd

49% Zambezi Resources Ltd

51% Lithic Metals and Energy Ltd

(51% after US$5M, upto 75% on DFS, 100% on sole funding)

*part of Zambezi Project (PL214):

Kangaluwi-Chisawa, Chakwenga Region, Other Chakwenga Region and Uranium JV Oryx

-------------------------------------------------------------

MERGER & AQUISITIONS

March 18, 2010 - LOI with AXMIN Inc

Acquisition by Axmin, wherby AfNat shareholders will hold 39.6% of Axmin

Axmin Inc (TSX-V:AXM) - as from June 14, 2010

(ex AfNat Resources Ltd - December 21, 2009)

(ex Lithic Metals and Energy Ltd - September 24, 2007)

(ex Zambezi Nickel Ltd - October 31, 2005)

Zambezi Resources Ltd (ASX:ZRL)

Position calculated from:

UTM Zone 35S (WGS84)

702500mE, 8278000mN

-15° 34' 3.28", +28° 53' 18.13"

Más sobre Chumbwe - Oryx U3O8 (Axmin)108: Collum Coal Mine (CCM)

Area

Other names: Kandabwe, Nkandabwe

Collum Coal Mining Industries Ltd

Zambias Collum coal mine to quadruple output by 2008

Mr Xu Jian Xue, chairman of privately-owned Collum Coal Mining Industries Ltd, told Reuters in an interview his firm expected to double its production to 240,000 tonnes in 2007 and then lift it to 480,000 tonnes the following year. "There is high demand for coal from the copper mines and we currently cannot meet that demand as we are still growing. The business atmosphere is looking good and, coupled with a friendly investment atmosphere we should be able to grow" Mr Xu said.

Mr Xu said demand for coal was also rising from Zambia's largest cement producer, Chilanga Cement Plc, due to the government's plans to start constructing two new power plants and many housing units this year.

Collum Coal Mining Industries is owned and run by five Chinese brothers who each invested a total of $5 million to start mining coal in Kandabwe, 400 kilometers south of the Zambian capital Lusaka. Collum Coal Mining Industries started production with output of 10,000 tonnes of coal per month last January

http://www.steelguru.com/selectednews/index/2006/004/025/archives.html  Más sobre Collum Coal Mine (CCM)

Más sobre Collum Coal Mine (CCM)109: Coloquo (African Eagle - CGA)

Other names: Kolokwo

Mkushi Exploration completed to date:

The original claims for Mkushi were transferred to Falcon Mines (Falcon) in 1926. Falcon carried out a programme of geophysical prospecting, identified a series of anomalies which were subsequently confirmed to be mineralised and reported an “in situ resource” of some 100,000 t at 4.5% Cu. Falcon, however, considered this to be too small and suspended operations.

In 1956, a pilot scale plant was brought in to conduct metallurgical test work. Reportedly, some 2,300 t of copper were recovered from some 70,000 t of ore milled, equating to a recovered grade of 3.5% Cu. Operations were suspended due to low copper prices until 1966, when L.G. Nichols obtained an option over the property. Two additional mineralised zones were located using geophysics and subsequent diamond drilling showed the deposits could be worked profitably by open pit methods. Financial difficulties, however, precluded Nichols from developing the property.

In 1968, Mkushi Copper Mines together with an Italian Mining company, Miniera di Fragne Chialamberto, began open pit mining at Munshiwemba. The pit reached a depth of 30m and yielded 2.2 Mt of ore at 1.0% Cu until operations ceased in 1975.